This is Buying Sandlot — the only newsletter that focuses solely on the business of youth sports.

Dick’s held their earnings call yesterday— and there was a heavy focus on GameChanger and youth sports overall.

We are entering a new paradigm, one where your friendly neighborhood sports app is set for global dominance. Here’s why.

And be sure to stay tuned at the end to learn how you can apply to join our premium Buying Sandlot community.

💸 Dick’s Earnings Call Focuses Heavily on GameChanger

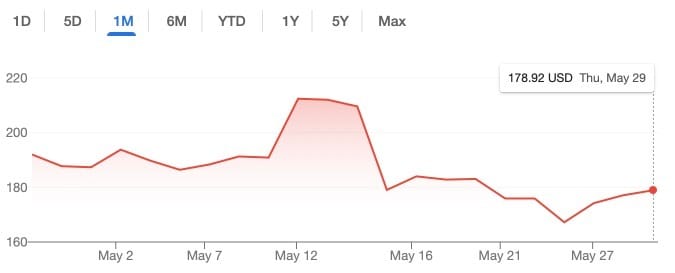

Overall, Dick’s beat on revenue ($3.18B) and earnings per share ($3.37), and saw same-store sales growth of 4.5%.

The stock rose about 2% on the news, but still hasn’t rebounded from the decline following the announcement of the Foot Locker acquisition on May 15:

Before we get into the specifics, I’d like to call your attention to two numbers:

29— the number of times GameChanger was mentioned on the call, compared to 19 in the same quarter last year

11— the number of times the word “media” was mentioned on the call, compared to 0 last year

Keep those in mind as we step through this (wearing Nike sneakers bought at Dick’s-owned Foot Locker suggested to you in the GameChanger app while viewing Dick’s Media Network content while at a port co Unrivaled Sports tournament).

📲 GameChanger

Some numbers:

6.5M unique active users in Q1, up 28% YoY

2.2M daily active users

Over $100M in revenue last year, and growing to a $150M business

Dick’s CEO Lauren Hobart 2025: “GameChanger is a live sports media platform that we're very excited to be able to put into our DICK'S Media Network.”

Dick’s CEO Lauren Hobart 2024: “The premier live streaming, scheduling, communications and scorekeeping mobile app.”

This tells the story right there— in one year, Dick’s has shifted from viewing GameChanger as a standalone youth sports app to a full-blown platform to drive sales and engagement. This was a theme during the call.

Dick’s is increasingly blending GameChanger into their core business— referring shoppers to GameChanger at the point of sale, and driving sales through GameChanger.

Hobart said GameChanger users are some of Dick’s best, highly-engaged shoppers.

GameChanger gives Dick’s touchpoints at every step of the athlete journey— from team sign up, to gameplay, to shopping, to viewing the game and data. All accelerated by their $120M investment in…

🏦 Unrivaled Sports

Dick’s’’’’ big news of the quarter was their huge investment in Unrivaled Sports, which owns Ripken Baseball, Cooperstown All-Star Village, and other large tournament venues.

Dick’s CFO Navdeep Gupta: “Now with the partnership and the equity investment that we have in Unrivaled, this gives us an opportunity to actually look at the ecosystem much more holistically and much more collectively between the GameChanger business and the Unrivaled opportunity that we have.”

Lots of corporate speak there, but Dick’s views the investment into Unrivaled Sports at a $600M valuation as a way to get on the ground at youth sporting events— a missing piece in their puzzle.

Notice how GameChanger gets woven into that comment. Dick’s has a piece of the tournament operator and the app everyone is using at said tournament. This is a strategic investment.

📺 Dick’s Media Network

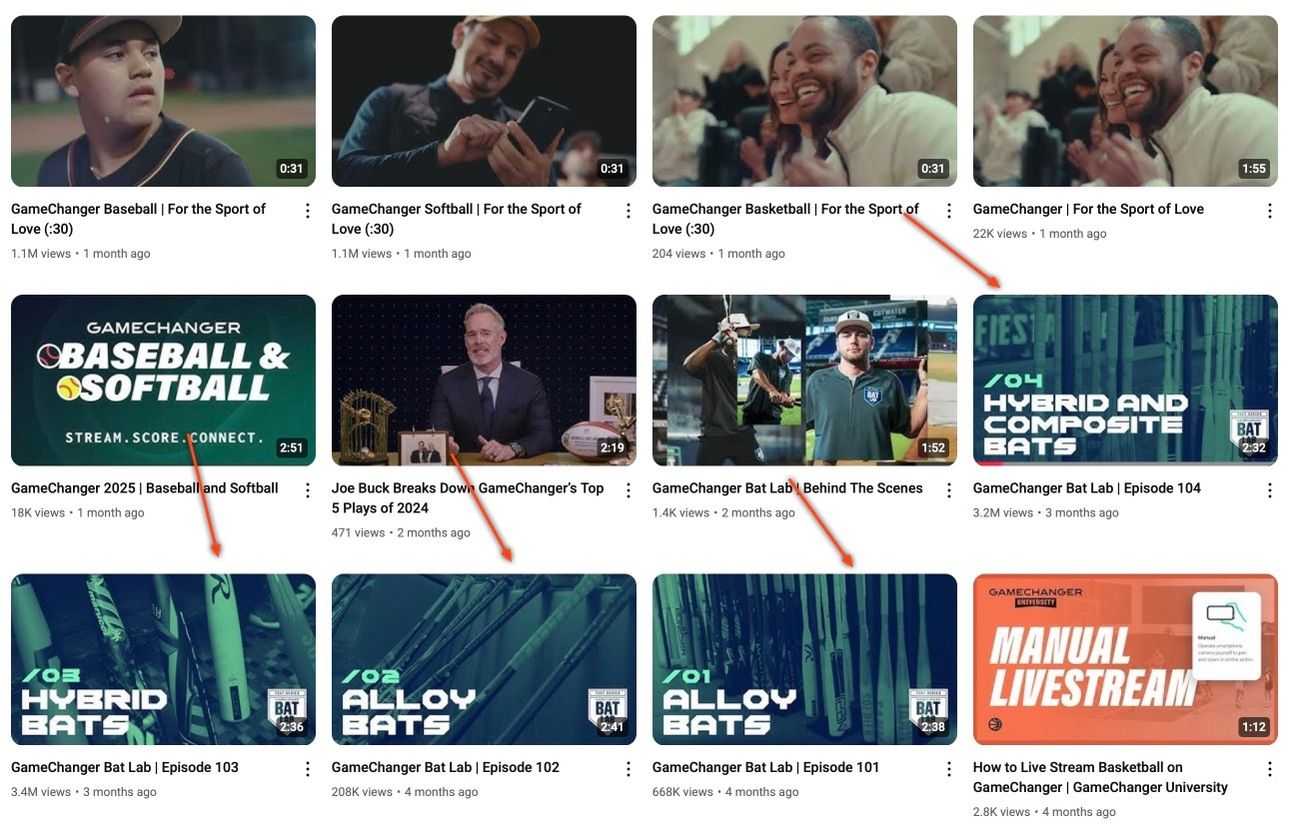

Dick’s Bat Lab videos are getting millions of views

This wasn’t really a thing last year.

Here’s how Dick’s described it on the call— see if you can spot the trend: “An in-house digital and retail media platform enabling targeted advertising to DICK'S customers and GameChanger users.”

Basically, DMN, which Dick’s said is experiencing “strong, profitable growth,” is an advertising network that works with brands to reach Dick’s customers on-site, through search and social, and, you guessed it, in the GameChanger app.

Think Amazon’s search business, sports-style.

But that might be underselling the branding potential.

Dick’s cited their Bat Lab series, where they “tested 12 different BB core bats using the GameChanger app and the platform,” as a great example of their media capabilities.

Those videos, posted to the GameChanger YouTube channel, garnered millions of views— a huge increase compared to the single-digit thousand view counts the channel typically gets on GameChanger tutorials and the like.

This is basically the definition of content + commerce:

So DMN is not just an ad platform for partner brands, it’s also driving brand awareness and culture for Dick’s, which brings us to…

👟 Foot Locker

Investors hate this acquisition. Foot Locker is a struggling and antiquated brand.

But as we told you in an earlier send, they are culturally relevant in footwear (especially in basketball, where Dick’s is softer) and they have an international footprint.

Here’s what I wrote two weeks ago:

Foot Locker is more closely associated with urban and streetwear culture, while Dick’s is more synonymous with suburbanites and athletes.

But sports + culture are becoming more intertwined, with basketball and soccer (and increasingly, baseball) leading the charge, domestically and internationally.

…

This thing about Foot Locker “youth basketball clinics” in Europe could just be a throwaway line in a press release… but Foot Locker opens a gateway for Dick’s et al into youth communities it had no way of reaching before.

Perhaps those communities would benefit from using an app like GameChanger.

Here’s Dick’s Executive Chairman Ed Stack yesterday:

“For many years, we've admired Foot Locker's brand and the powerful community they built from sneaker culture. By bringing our two great brands together, we see the opportunity to create a global leader in the sports retail industry, one that serves more types of athletes, consumers, and communities than we do today.

This combination positions us to participate in the $300 billion global sports retail market and expands our reach to over 3,200 stores worldwide.

By applying the operational expertise we've built over the years, we will help unlock the next chapter of growth for Foot Locker.”

I don’t know why you’d read any other newsletter.

Overall, the takeaway here is clear: Dick’s is no longer just a retailer. They are becoming a global sports commerce + content platform built around GameChanger.

Long Dick’s, I am.

As mentioned in previous emails, we are soon launching a premium Buying Sandlot community that will cater to the unique needs of the youth sports business community.

Unlike other areas of sports, there are countless small- and medium-sized businesses in youth sports that are not seeking venture-scale returns, but are simply looking for knowledge, partnerships, and opportunities.

While investments are a part of this, the focus is also on shareable knowledge between geographically diffuse facility owners, event organizers, club and league admins, service providers, and even public officials.

Members get:

Access to a private curated Slack group— with dedicated channels for facilities, events, leagues and clubs, tech, investment, and public policy.

The ability to post and browse investment opportunities in youth sports

Access to monthly benchmarking reports on specific youth sports segments— first up, results from our facility owners survey

30-minute call with me to discuss your business, pitch your product or service for a story, network, or seek an introduction to another community member

Event access— members get to attend smaller 1-day events for free (we plan to host our first in the fall in the Northeast) and get 20% off conference tickets (we plan to hold our first business of youth sports conference next spring)

FREE ADVERTISING in Buying Sandlot— every annual subscriber gets to sponsor a Buying Sandlot email, reaching more than 4,400+ (and growing rapidly!) professionals in the space. This is obviously not scaleable and limited to early members.

The cost for early members will be $45 per month or $499 annually.

To ensure a quality community that drives value for all members, the premium Buying Sandlot community will be invite-only to start.

You can apply to join by clicking this link. There’s no commitment when you apply. If your application is accepted, we will send you a link to pay when we officially launch the community.

We’re new— help us build up our social media accounts by following along:

Good game.